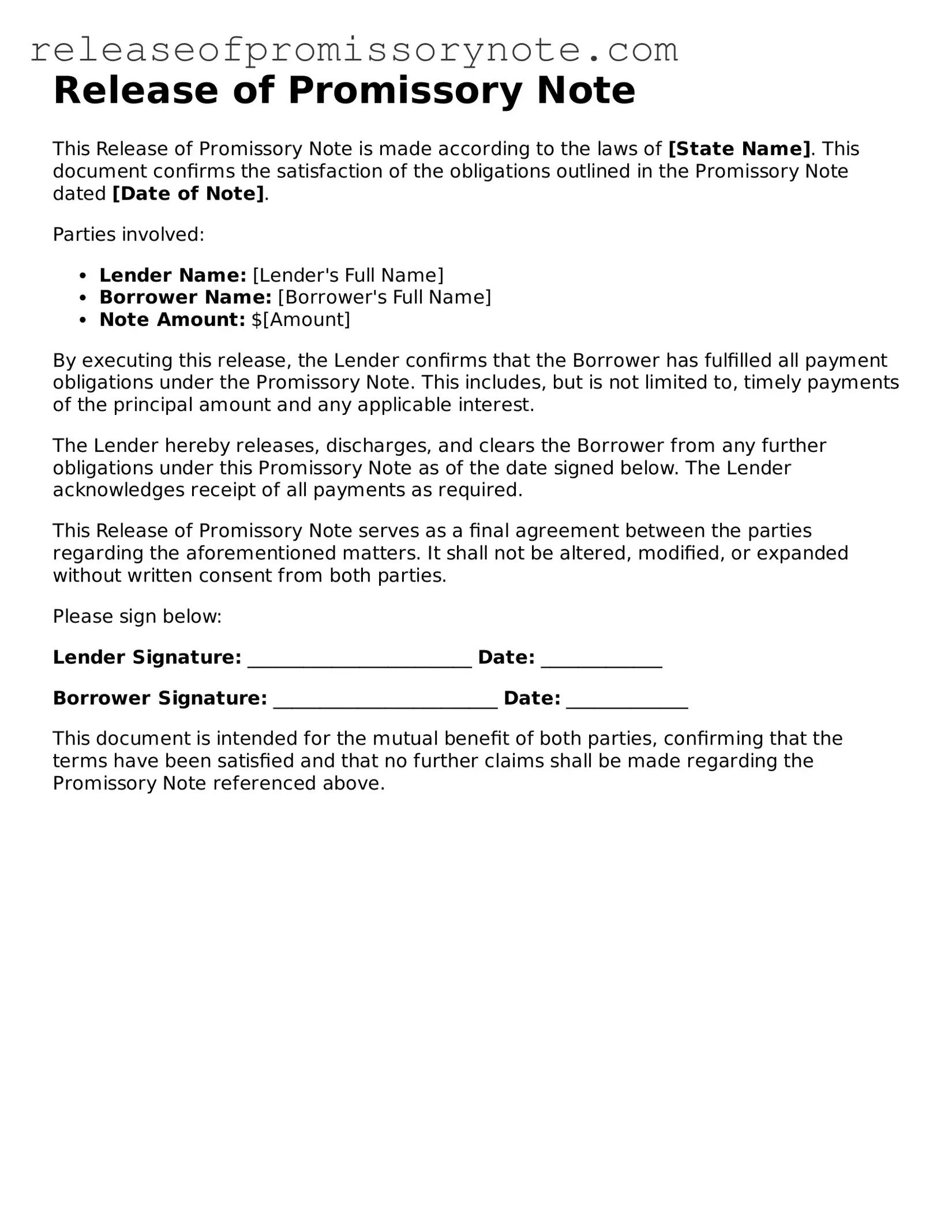

A Release of Promissory Note form is a legal document that signifies the cancellation of a promissory note. It indicates that the borrower has fulfilled their obligation to repay the loan, and the lender formally releases any claim to the debt.

You should use this form when the borrower has paid off the loan in full, and both parties agree that the debt no longer exists. It serves as proof that the lender has no further claims against the borrower regarding that specific loan.

Who should sign the Release of Promissory Note?

Both the lender and the borrower should sign the form. The lender’s signature confirms that they are releasing the borrower from the debt, while the borrower’s signature acknowledges that the debt has been satisfied.

While not always required, having the document notarized adds an extra layer of validity. A notary public can verify the identities of the signers and ensure that the signatures are genuine, which may be helpful if disputes arise later.

If you do not use the Release of Promissory Note form after paying off your loan, the lender may still have a claim against you for the debt. This could lead to misunderstandings or disputes in the future. It’s always best to have clear documentation.

While you can use a generic template, it’s important to ensure that it meets your specific needs and complies with your state’s laws. Tailoring the document to your situation can help avoid issues down the line.

Typically, there is no fee to file a Release of Promissory Note, as it is often a private agreement between the lender and borrower. However, if you choose to have the document notarized or recorded with a government office, there may be associated fees.

After completing the form, store it in a safe place, such as a locked file cabinet or a secure digital location. Both parties should keep a copy for their records to ensure that they have proof of the release in the future.

What if the lender refuses to sign the release?

If the lender refuses to sign the release despite the loan being paid off, you may need to provide evidence of payment, such as bank statements or receipts. In some cases, legal assistance may be necessary to resolve the issue.

Yes, the Release of Promissory Note form can generally be used for any type of loan that involves a promissory note. This includes personal loans, business loans, and even certain types of mortgages. Always ensure that the form is appropriate for your specific situation.